Strategy, formerly known as MicroStrategy, has announced its plan to raise $2 billion through the issuance of zero-interest convertible bonds. The company intends to use the proceeds to purchase additional Bitcoin, reinforcing its position as one of the largest corporate holders of BTC worldwide.

Details of the Bond Issuance Plan

According to the official announcement, Strategy will issue a tranche of bonds with a five-year maturity, set to expire in 2030. These bonds will carry no periodic interest payments but can be converted into the company’s shares at a preferential rate in the future.

This move is in line with Strategy’s long-term approach of accumulating Bitcoin as a strategic reserve asset. Given Bitcoin’s current price hovering around $52,000, the funds raised could enable the company to purchase approximately 38,500 BTC.

Strategy’s Goal to Strengthen Its Position

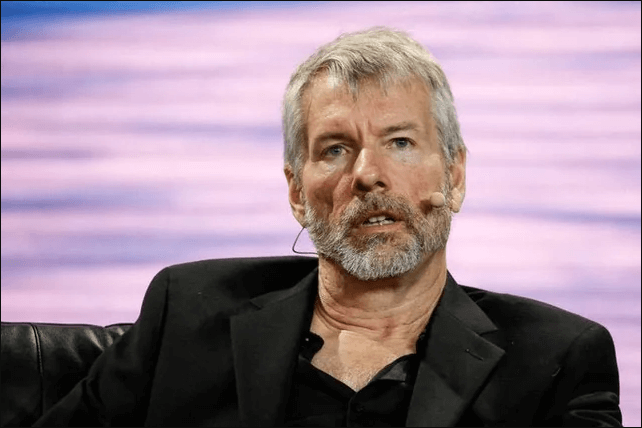

Michael Saylor, the CEO and a well-known Bitcoin advocate, emphasized that this initiative will help the company expand its asset holdings and secure long-term advantages:

“Bitcoin is the safest asset humanity has ever created. We believe that increasing our Bitcoin holdings will ensure Strategy’s sustainable growth in the future.”

Currently, Strategy holds over 190,000 BTC, valued at approximately $9.8 billion at market prices. With this new initiative, the company’s holdings could exceed 225,000 BTC, provided that Bitcoin’s price remains stable.

Impact on the Bitcoin Market

The announcement of the bond issuance immediately triggered a positive response in the market. Bitcoin’s price rose by 2.5% within 24 hours following the news, reaching $53,200. Analysts suggest that Strategy’s continuous accumulation of Bitcoin could contribute to reducing its market supply, potentially driving prices even higher.

However, some investors have expressed concerns about the risks associated with borrowing large sums to acquire an asset as volatile as Bitcoin. Previously, Strategy’s convertible bond issuances sparked debates within financial circles about the sustainability of such aggressive accumulation strategies.

Conclusion

Strategy’s move to raise $2 billion for further Bitcoin purchases signals strong confidence in BTC’s long-term growth. It also underscores the growing trend of major corporations using Bitcoin as a reserve asset. Nevertheless, given the inherent volatility of the cryptocurrency market, the effectiveness of this strategy will be closely monitored in the coming years.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.