In a landmark move that could reshape the future of digital asset regulation in the United States, the Securities and Exchange Commission (SEC) has announced the launch of a new initiative dubbed “Project Crypto.” This program is designed to provide a structured, transparent framework for the regulation of cryptocurrencies, tokenized securities, stablecoins, and blockchain-based financial platforms.

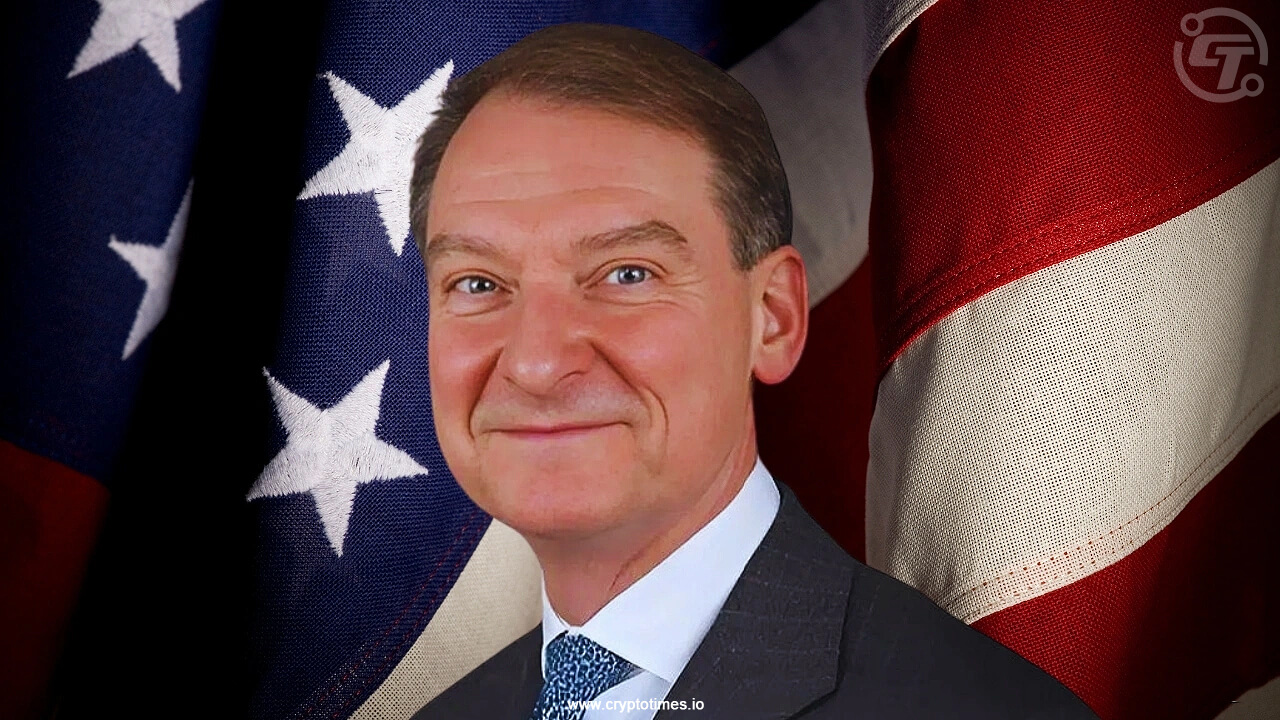

Under the leadership of SEC Chair Paul Atkins, Project Crypto signals a shift in tone and direction for the agency, which has long been criticized for its ambiguous stance and enforcement-heavy approach toward digital assets. With the launch of this initiative, the SEC appears to be acknowledging the growing maturity of the crypto sector and its potential to become a mainstream part of the financial ecosystem—provided that appropriate guardrails are in place.

Toward a Unified Framework

At the heart of Project Crypto is the goal of creating a unified, modern regulatory environment that addresses the unique characteristics of blockchain-based assets without stifling innovation. The initiative will focus on defining key classifications such as:

-

Security Tokens vs. Utility Tokens

-

The criteria for decentralization

-

Regulatory treatment of stablecoins and algorithmic assets

-

Disclosure and compliance standards for Initial Coin Offerings (ICOs) and Token Generation Events (TGEs)

The SEC has stated that it intends to collaborate with other federal agencies, including the Commodity Futures Trading Commission (CFTC), the Office of the Comptroller of the Currency (OCC), and the Financial Crimes Enforcement Network (FinCEN), to create a harmonized regulatory approach. This interagency cooperation aims to prevent regulatory overlap and provide clarity for developers, investors, and financial institutions.

A Shift from Enforcement to Guidance

In recent years, the SEC’s regulation-by-enforcement approach has led to criticism and legal challenges from both crypto startups and established firms. Many in the industry have argued that the lack of proactive guidance and the inconsistent application of securities laws have created unnecessary confusion and risk.

Project Crypto marks a turning point. Instead of retroactively penalizing firms for noncompliance with unclear rules, the SEC intends to provide clear pathways for compliance—before enforcement actions are taken.

In a public statement, Chair Atkins said, “The digital asset space has evolved beyond a speculative niche into a serious component of modern finance. Our goal is not to hinder progress, but to protect investors while enabling responsible innovation.”

Industry Response

The crypto industry has welcomed the announcement with cautious optimism. Several leading figures, including executives from Coinbase, Kraken, and Circle, have expressed hope that Project Crypto will bring long-overdue regulatory certainty to the market.

“This could be the regulatory foundation that finally allows U.S.-based crypto innovation to flourish,” said a spokesperson from the Blockchain Association. “But the details matter. The success of this project will depend on how flexible, inclusive, and future-proof the final framework turns out to be.”

Institutional investors have also shown renewed interest, with some viewing Project Crypto as a green light for expanded crypto exposure—particularly through regulated instruments such as exchange-traded funds (ETFs), security token offerings (STOs), and tokenized real-world assets.

Key Areas of Focus

According to internal documents and early statements from SEC officials, Project Crypto will initially focus on five core pillars:

-

Token Classification: Establishing consistent standards to distinguish securities from non-securities.

-

Stablecoin Oversight: Creating a regulatory model for fiat-backed and algorithmic stablecoins, potentially in partnership with the Federal Reserve.

-

Exchange Licensing: Introducing new categories of registration for decentralized and centralized digital asset platforms.

-

Custody and Audit: Developing secure and auditable custody requirements for crypto funds and assets.

-

Investor Protection: Requiring enhanced disclosures for token issuers and ensuring fair access to markets.

These areas align closely with ongoing legislative efforts in Congress to codify digital asset law, suggesting that Project Crypto may serve as both a precursor and a complement to future federal legislation.

Looking Ahead

Project Crypto is still in its early stages, and its ultimate success will depend on a delicate balance between regulation and innovation. However, it marks a clear acknowledgment from one of the world’s most influential regulatory bodies that crypto is no longer fringe—it is foundational.

As the SEC moves forward with public consultations, stakeholder engagement, and eventual rulemaking, the crypto community will be watching closely. For the first time in years, the path to regulatory clarity in the U.S. may be opening—and it starts with Project Crypto.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.