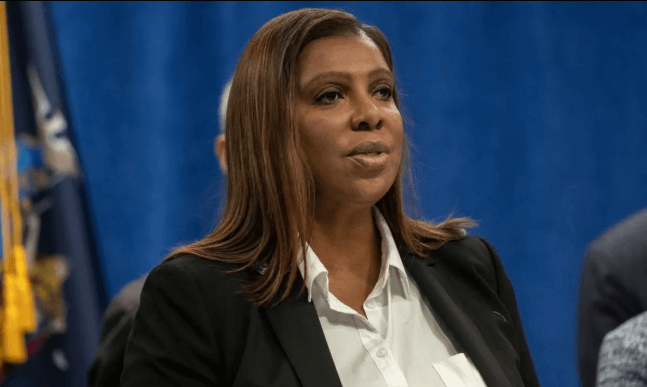

New York Attorney General Letitia James has called on Congress to take urgent action to establish a comprehensive federal regulatory framework for cryptocurrencies, citing growing concerns over fraud, manipulation, and investor harm in the digital asset space.

In a formal letter addressed to congressional leaders, James emphasized that the current patchwork of state-level oversight and fragmented federal authority has created a dangerous environment for retail investors. She argued that without consistent rules and robust enforcement, the crypto market will continue to be plagued by high-profile collapses, predatory schemes, and regulatory arbitrage.

“Millions of Americans have been exposed to unregulated crypto investments that promise high returns but deliver devastating losses,” James wrote. “Congress must act now to bring clarity and accountability to this market before more lives are financially ruined.”

James’s plea comes amid an intensifying debate over how to regulate digital assets in the United States. While agencies like the SEC and CFTC have taken enforcement actions against individual projects and exchanges, their overlapping jurisdictions and differing interpretations of what constitutes a security versus a commodity have led to confusion across the industry.

The attorney general’s office has been one of the most active state regulators in pursuing crypto-related fraud. Over the past two years, it has brought lawsuits against major players including CoinEx, KuCoin, and Celsius, and has secured millions of dollars in restitution for investors. James argued that a national regulatory structure would empower state-level authorities to coordinate more effectively with federal agencies, ensuring that bad actors are held accountable regardless of where they operate.

In her recommendations, James urged Congress to:

-

Define digital assets clearly as securities or commodities,

-

Establish mandatory registration requirements for all crypto exchanges and token issuers,

-

Enforce strict anti-money laundering (AML) and know-your-customer (KYC) rules,

-

Increase funding for enforcement agencies to investigate and prosecute crypto crimes.

Investor advocacy groups have widely applauded the initiative, saying that retail participants are often misled by deceptive marketing or left unprotected in cases of fraud or bankruptcy. “Crypto shouldn’t be the Wild West,” said one consumer protection watchdog. “It’s time for Washington to step in and make rules that put investors first.”

However, some in the crypto industry view the push for stricter federal oversight as a threat to innovation. They argue that excessive regulation could drive startups and capital overseas, stifling the growth of blockchain technology in the U.S. Others, including several lawmakers, are pushing for a more balanced approach that fosters innovation while protecting consumers.

As crypto markets recover from a series of scandals — including the FTX collapse, Terra’s implosion, and numerous rug pulls — the political will to regulate appears to be gaining momentum. Whether Congress will respond to Letitia James’s call with unified legislative action remains to be seen, but the message is clear: the era of regulatory ambiguity in crypto may soon be coming to an end.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.