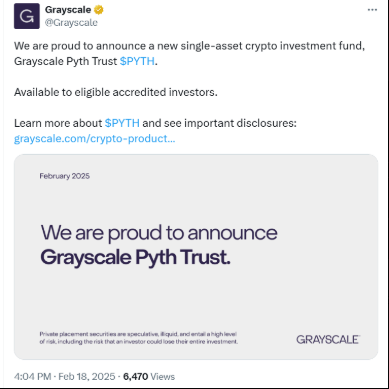

Grayscale Investments, one of the largest digital asset management firms, has announced the launch of its newest product, the Grayscale Pyth Trust. This investment vehicle is designed to provide accredited investors with direct exposure to Pyth Network’s native token, PYTH, further expanding Grayscale’s growing portfolio of single-asset cryptocurrency investment funds.

What is Pyth Network?

Pyth Network is a decentralized oracle solution that focuses on providing high-fidelity, real-time market data for various asset classes, including cryptocurrencies, equities, commodities, and forex. By aggregating data from institutional sources and delivering it on-chain, Pyth aims to enhance the accuracy and efficiency of DeFi applications. The launch of the Grayscale Pyth Trust underscores the increasing importance of decentralized oracles in the blockchain ecosystem.

Why Grayscale is Betting on Pyth?

Grayscale has long been at the forefront of institutional cryptocurrency investment, offering products for Bitcoin, Ethereum, Solana, and other major assets. The decision to introduce a Pyth-focused trust aligns with the company’s strategy of identifying and supporting emerging blockchain technologies that have strong potential for widespread adoption.

Key reasons for Grayscale’s interest in Pyth include:

- Decentralized Oracle Innovation – Pyth’s ability to provide real-time data on-chain reduces reliance on centralized data providers.

- Institutional Adoption – Many leading financial firms and exchanges have started integrating Pyth’s data into their trading platforms.

- DeFi Expansion – As decentralized finance continues to grow, reliable and accurate data feeds are becoming increasingly essential.

Impact on the Crypto Market

The introduction of the Grayscale Pyth Trust is expected to increase institutional interest in the PYTH token. Historically, Grayscale’s investment products have played a significant role in increasing mainstream adoption of digital assets by providing traditional investors with regulatory-compliant exposure to cryptocurrencies.

Market analysts suggest that if institutional demand for PYTH rises, its price could experience notable upward momentum. However, like all digital assets, it remains subject to market volatility and regulatory scrutiny.

Conclusion

With the launch of the Grayscale Pyth Trust, investors now have a new way to gain exposure to the expanding decentralized oracle sector. The move signals growing confidence in blockchain-based data solutions and their role in the future of finance. As adoption continues to rise, both retail and institutional investors will be watching closely to see how Pyth Network evolves in the rapidly changing crypto landscape.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.