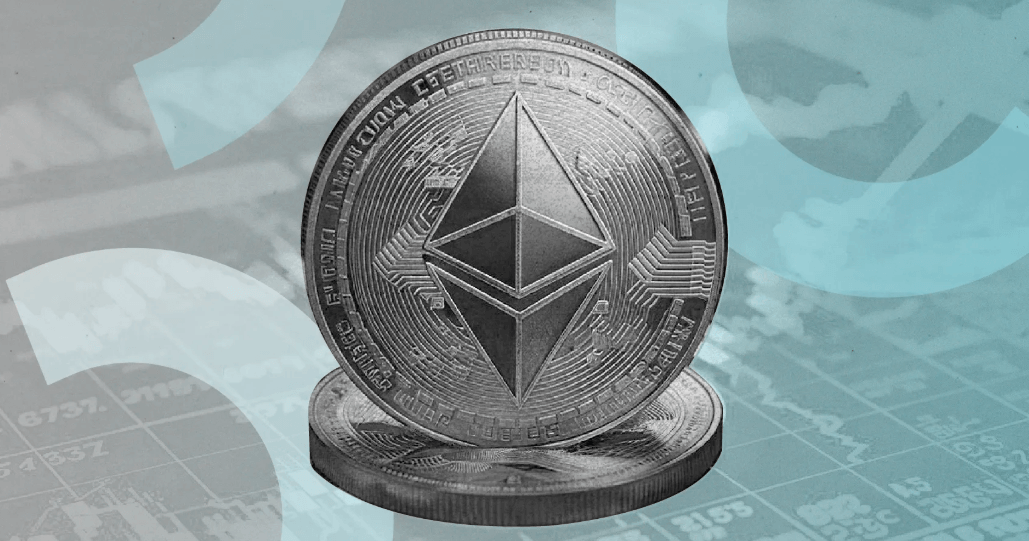

The decentralized finance (DeFi) market experienced a historic milestone in December 2024, with trading volume on decentralized exchanges (DEXs) soaring to an unprecedented $462 billion. This remarkable growth highlights the increasing adoption of DeFi protocols amid regulatory uncertainty and the broader shift toward decentralized financial systems.

Key Drivers Behind the Surge

- Increased Institutional Interest

Institutional investors have been gradually embracing DeFi platforms as alternatives to traditional finance, contributing to the record-breaking trading volume. Major financial players are exploring liquidity provision and yield farming strategies to optimize their portfolios. - Growth of Layer-2 Solutions

The adoption of Layer-2 scaling solutions such as Arbitrum, Optimism, and zkSync has significantly reduced transaction costs and increased throughput on Ethereum-based DEXs, making DeFi more accessible to retail and institutional traders. - Regulatory Challenges Driving Decentralization

Heightened scrutiny on centralized exchanges (CEXs) following multiple enforcement actions by regulators has pushed more traders toward decentralized alternatives, where users retain full control over their assets. - Rising Popularity of Liquid Staking and Yield Aggregators

Liquid staking protocols and yield aggregation platforms have driven increased trading activity, as users seek to maximize returns on their crypto holdings while maintaining liquidity.

Implications for the Crypto Market

- The record volume underscores the resilience of DeFi despite global regulatory pressures.

- More innovation in automated market makers (AMMs) and cross-chain liquidity solutions is expected to sustain the growth of DEX trading.

- Traditional financial institutions may increasingly collaborate with DeFi platforms to integrate blockchain-based solutions into their services.

Looking Ahead

With DeFi continuing to evolve rapidly, the sector is expected to see further innovation in security, user experience, and institutional-grade solutions. If the current momentum continues, decentralized exchanges could soon rival centralized platforms in liquidity and adoption, reshaping the future of finance.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.