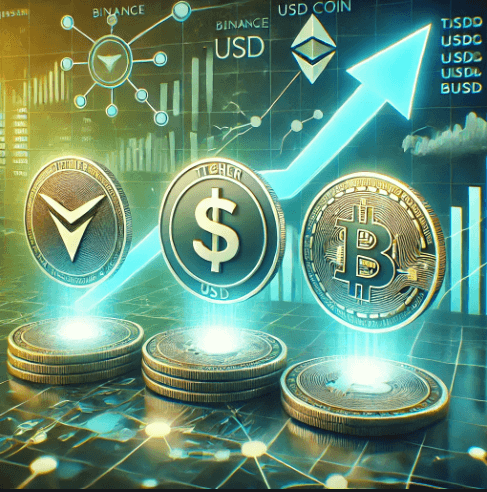

The stablecoin market is witnessing a significant surge in market capitalization as demand for digital dollar-pegged assets continues to grow. This increase is driven by rising institutional adoption, heightened interest in decentralized finance (DeFi), and a broader shift towards digital asset stability in the crypto market.

Stablecoin Market Sees Robust Growth

According to recent market data, the total stablecoin market capitalization has experienced a steady increase, with leading stablecoins such as Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) seeing rising inflows. This trend indicates that investors and traders are increasingly relying on stablecoins for liquidity, hedging against volatility, and conducting cross-border transactions.

One of the primary factors contributing to this growth is the expansion of stablecoin use cases beyond trading. Institutional investors and corporations are utilizing stablecoins for payments, remittances, and on-chain settlements, further solidifying their role as an essential component of the digital economy.

Regulatory Landscape and Market Confidence

Despite regulatory scrutiny surrounding stablecoins, recent developments suggest increasing regulatory clarity, particularly in key markets such as the United States and the European Union. Governments and financial regulators are exploring stablecoin frameworks to ensure transparency, security, and compliance, which has contributed to growing investor confidence.

The introduction of regulations such as the Markets in Crypto-Assets (MiCA) framework in Europe and ongoing discussions around stablecoin oversight in the U.S. have provided a clearer roadmap for stablecoin issuers. As a result, major players in the space are working towards increased transparency in reserve management and compliance with regulatory requirements.

Future Outlook: Continued Expansion Ahead?

As stablecoins continue to see increasing adoption, their role in the financial system is expected to expand further. With advancements in blockchain technology and the growing integration of stablecoins into payment systems and institutional finance, the sector is likely to witness further growth in market capitalization.

Additionally, the rise of algorithmic stablecoins and innovations in decentralized finance (DeFi) are set to reshape the landscape, offering alternative forms of digital stability. However, market participants will need to navigate evolving regulations and ensure robust reserve backing to maintain trust and stability.

With the stablecoin market showing no signs of slowing down, its expanding capitalization marks a critical step toward the maturation of the cryptocurrency industry. Whether through institutional adoption, DeFi innovations, or regulatory advancements, stablecoins remain a key pillar of the evolving digital financial ecosystem.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.