In a bold move that underscores its unwavering conviction in digital assets, MicroStrategy has announced that it has successfully raised $2.8 billion through a large‑scale preferred stock offering. The funds will be used primarily to acquire additional Bitcoin, further cementing the company’s position as the largest corporate holder of the cryptocurrency.

The offering, known internally as the Series A Stretch Preferred Shares, was initially planned at half a billion dollars but was dramatically upsized after demand from investors far exceeded expectations. Each share carries a fixed annual dividend of 9%, paid monthly, and is designed as a perpetual instrument, giving the company flexibility without the pressure of a looming maturity date.

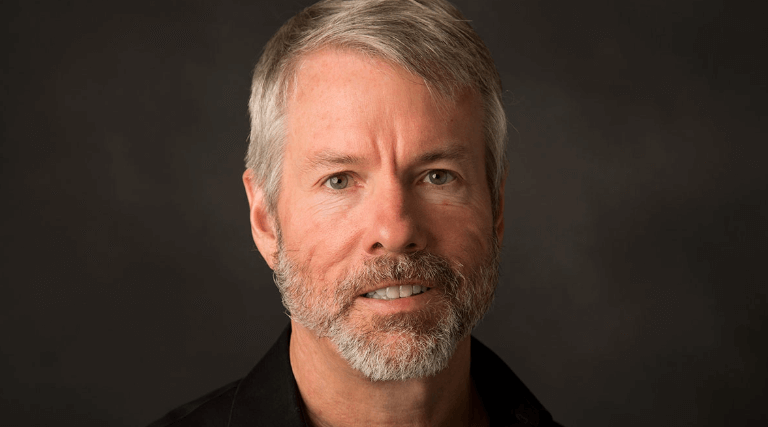

MicroStrategy’s leadership described the offering as both a financing innovation and a long‑term bet on the future of Bitcoin. According to executives, the goal is not simply to add Bitcoin as a speculative investment, but to anchor the company’s balance sheet in what they view as a superior store of value. This strategy has already seen the company accumulate more than 600,000 BTC, with plans to continue buying aggressively in the months ahead.

Market observers note that MicroStrategy’s approach is unlike anything seen before in traditional corporate finance. Instead of borrowing to fund expansion of software products or acquisitions, the firm is using its capital to build a strategic Bitcoin reserve. Analysts point out that this move could lead to outsized gains if Bitcoin continues its upward trajectory, but it also introduces significant volatility to the company’s financial profile.

The preferred stock structure was designed to appeal to income‑oriented investors while giving MicroStrategy the liquidity it needs to pursue its Bitcoin strategy. Backed by major investment banks, the offering drew interest from a mix of institutional funds, family offices, and crypto‑focused investors eager to gain indirect exposure to Bitcoin through a regulated equity vehicle.

Critics, however, warn that the strategy increases the company’s financial leverage and ties its fortunes more closely to the swings of the cryptocurrency market. A sudden downturn in Bitcoin’s price could erode the value of its treasury, leaving the company to manage ongoing dividend obligations.

Despite these concerns, MicroStrategy’s leadership remains steadfast. “We view Bitcoin as a generational asset,” a company spokesperson said in a statement. “By aligning our capital structure with this belief, we are building a balance sheet for the future.”

With billions now secured and a clear mandate to expand its Bitcoin holdings, MicroStrategy has once again positioned itself at the center of the conversation about corporate adoption of digital assets. Whether this bold move becomes a template for others—or a cautionary tale—will depend on how the world’s most valuable cryptocurrency performs in the years to come.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.