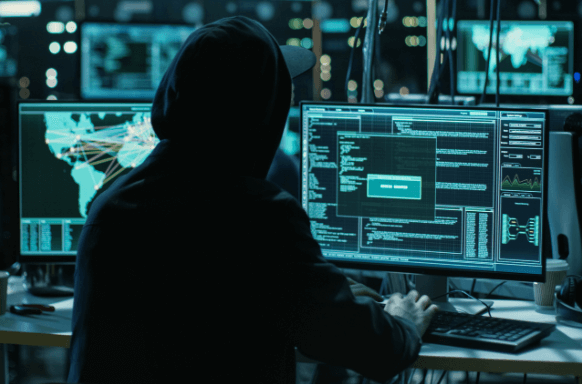

The decentralized finance (DeFi) sector is witnessing a rise in security breaches, with hackers targeting vulnerabilities in smart contracts and protocols. Recent reports indicate that DeFi-related exploits have resulted in losses exceeding $1 billion in 2024 alone, raising concerns over the safety of decentralized financial applications.

Common DeFi Security Threats

Several key security risks have contributed to the growing number of hacks in the DeFi space:

- Smart Contract Vulnerabilities: Bugs and loopholes in smart contract code remain a primary target for hackers.

- Flash Loan Attacks: Malicious actors exploit unsecured lending mechanisms to manipulate prices and drain liquidity pools.

- Phishing Scams: Users are frequently tricked into connecting wallets to fraudulent dApps, leading to asset theft.

- Oracle Manipulation: Attackers exploit weak price feed mechanisms to execute fraudulent trades.

Notable Recent Attacks

Some high-profile DeFi hacks in 2024 include:

- An $80 million exploit on a major lending protocol due to a smart contract bug.

- A $150 million bridge attack, where hackers compromised cross-chain infrastructure.

- Multiple rug pulls, with project founders disappearing after raising significant funds.

Strengthening DeFi Security

As security threats escalate, developers and auditors are prioritizing enhanced security measures:

- Code Audits: Regular smart contract audits help identify vulnerabilities before they are exploited.

- Bug Bounty Programs: Platforms are offering rewards to ethical hackers for discovering potential weaknesses.

- Decentralized Insurance: Some DeFi protocols are now offering coverage for users affected by hacks.

Future Outlook

The DeFi industry must continue evolving to counteract growing security risks. Increased regulatory oversight, improved risk management tools, and advancements in blockchain security could help mitigate vulnerabilities, ensuring a safer DeFi ecosystem for users and investors.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.