Introduction

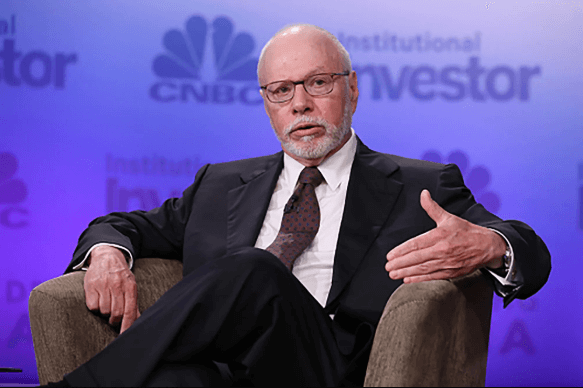

Billionaire investor Paul Singer has raised concerns about the current state of global financial markets, emphasizing the risks associated with stock markets and the growing threat of cryptocurrencies to the dominance of the U.S. dollar. His warnings reflect broader anxieties about economic instability and the future of traditional financial systems.

Stock Market Risks

Singer highlights several factors contributing to stock market volatility:

- Excessive Valuations: Many stocks, especially in the technology sector, remain overvalued despite recent corrections.

- Macroeconomic Uncertainty: Inflation, interest rate hikes, and geopolitical tensions continue to create uncertainty in global markets.

- Corporate Debt Levels: High levels of corporate borrowing could pose risks in an environment of rising interest rates.

- Potential Recession: Many analysts, including Singer, warn of a potential economic downturn that could further strain stock market performance.

Crypto’s Challenge to Dollar Dominance

Singer also warns that the rise of cryptocurrencies presents a significant challenge to the U.S. dollar’s global status. Key concerns include:

- Decentralization: Unlike fiat currencies controlled by central banks, cryptocurrencies operate outside traditional financial systems, reducing reliance on the dollar.

- Adoption in International Trade: Some countries and businesses are increasingly using digital assets for transactions, bypassing the dollar-based financial system.

- Inflation Hedge: Cryptocurrencies like Bitcoin are seen as alternative stores of value, attracting investors concerned about currency devaluation.

- Regulatory Uncertainty: Governments worldwide are struggling to develop coherent policies for digital assets, adding to financial system uncertainty.

Implications for Investors and Policymakers

Singer’s warnings suggest the need for:

- Diversified Investment Strategies: Investors may need to look beyond traditional stock markets and consider alternative assets to mitigate risk.

- Regulatory Clarity: Governments must develop comprehensive policies to manage cryptocurrency adoption while preserving financial stability.

- Monetary Policy Adjustments: Central banks may need to reconsider their approaches to currency management in response to digital asset growth.

Conclusion

Paul Singer’s concerns highlight the shifting landscape of global finance, where stock markets face increasing risks and cryptocurrencies challenge traditional monetary systems. As uncertainty grows, investors and policymakers alike must navigate an evolving financial environment to ensure stability and long-term economic resilience.

References

- Market analysis reports

- Statements from Paul Singer

- Regulatory developments in cryptocurrency

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decisions. We are not responsible for your investment decisions.

Fxfx333, essa parada é boa demais! Tô curtindo apostar por aqui, os jogos são irados. Recomendo pra quem tá querendo uma grana extra e se divertir. Dá uma olhada aqui: fxfx333